photosvit

Cruise lines recently took a big step to lift some of the last remaining Covid restrictions preventing guests from taking cruises. Unfortunately, updated Carnival Corp. (NYSE: CCL) plans were too late for the summer of 2022 cruise season and still restrictive for unvaccinated passengers. Mine investment thesis remains bullish on a full recovery in 2023, but cruise lines must become more aggressive in combating any and all COVID restrictions.

Cruise past Covid

On August 12, Carnival lifted health restrictions regarding Covid vaccinations and specifically testing for cruises departing on or after September 6. Vaccinated guests no longer need a negative test to board a cruise, and unvaccinated guests can now travel with a negative test within 3 days of departure. Some restrictions remain in effect depending on the location of the cruise.

The cruise line only had test protocols set on July 29. The biggest move was the elimination of pre-cruise testing for fully vaccinated guests on cruises with itineraries of 5 nights or less.

Anyone who has been following Covid for the last two years knows that a negative test 3 days before boarding a ship does not prevent a passenger from actually having Covid at the time of travel. These Covid testing requirements are illogical and go beyond any requirement to fly or stay in a hotel within the country.

Streamlined protocols are clearly required, with Carnival doubling bookings on August 15 compared to the equivalent day in 2019. Now, a one-day surge in bookings doesn’t trend, or change the picture in a meaningful way, but it does provide a signal of strong pent-up demand for loosened restrictions. Carnival should be expected to post some strong bookings for 2023 as guests see a light at the end of the tunnel while bookings into 2022 may remain limited due to displacement restrictions and the end of the summer cruise season.

Again on the FQ2’22 earnings call, CFO David Bernstein had already highlighted a strong advanced booking position compared to 2019:

For all of 2023, our cumulative advanced book position continues to be at the higher end of the historical range and at higher prices, with or without FCC, normalized for bundled packages compared to 2019 sailings. This is a great achievement considering that the price for bookings for 2019 cruises is a difficult comparison as it was a high watermark for historical yield.

Full recovery in 2023

The cruise line sold 102.1 million shares of common stock at $9.95 a share on July 20, raising about $1 billion in cash. Carnival intends to use the proceeds for general corporate purposes or to address 2023 debt maturities.

The company needing to sell more equity was very disappointing in hopes that the cruise lines would return to profitable operations in 2022. Not to mention, the offering was priced just under $10 while the stock traded above $20 for the most part. big in 2021 and in 2022.

Carnival was cash flow positive last quarter due to payments for advanced bookings through 2023. The cruise line generated $1.4 billion in advance bookings, but Carnival reported a $900 million EBITDA loss. The company had $375 million in interest expense, cutting off most of its positive cash flows.

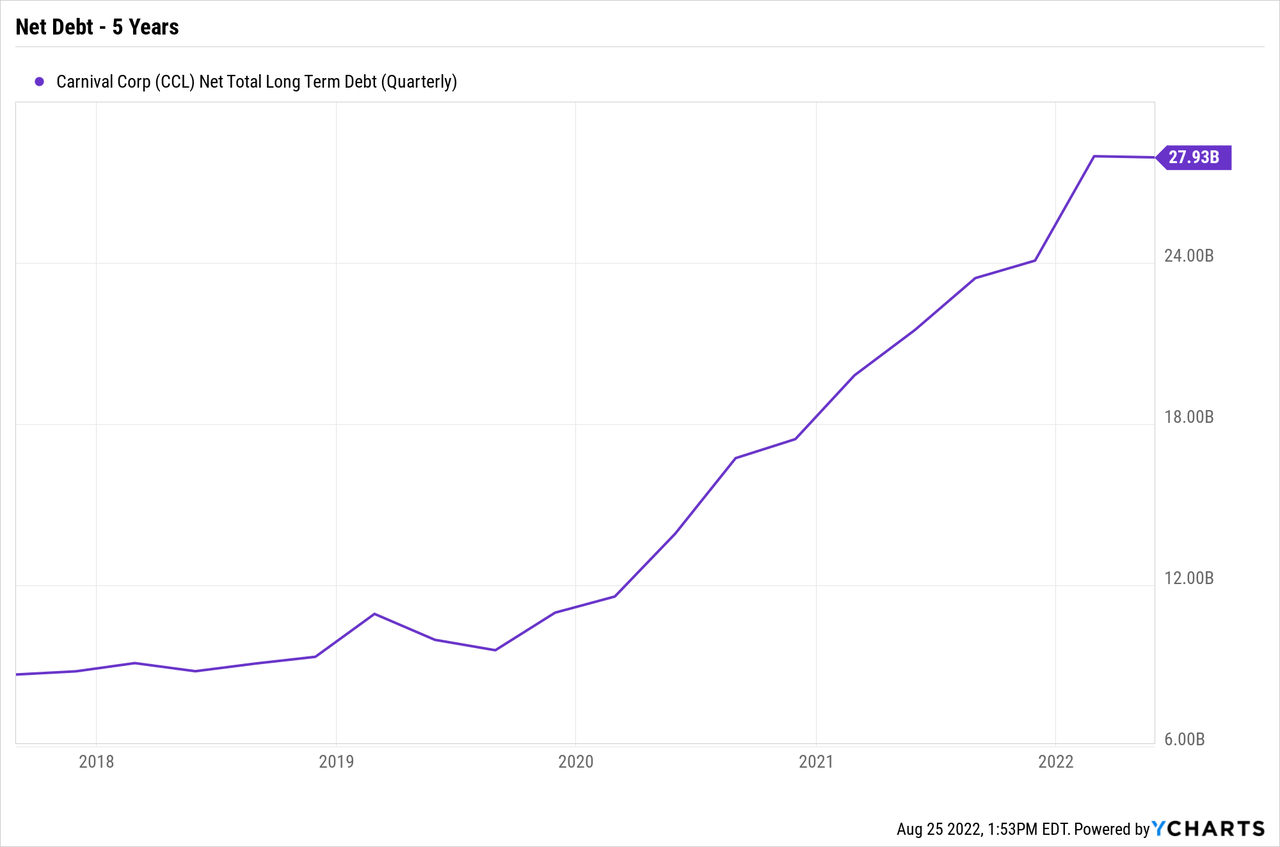

The cruise line saw debt levels rise to $27.9 billion during the Covid shutdowns, and the hope was that the company would not need to sell more equity as operations resumed. The market cap was just $12 billion with shares trading below $10 while Carnival ended last quarter with a cash balance of $7.2 billion.

The big question is what a full recovery looks like in 2023 with much higher stock counts and debt levels combined with higher projected capacity. Analysts have Carnival on a path to EPS of $1.50 to $2.00 in FY24/25 providing a general indication of where dilution takes a more normalized operation.

Of course, any earning power is not fully realized until Carnival cuts its debt level significantly from current levels, aiming to eventually reach pre-Covid debt levels with annual interest expense of $200 million compared to the current level of ~1.5 billion dollars. Even in a scenario of higher shares outstanding, the cruise line could still generate $1 in additional EPS from reducing interest expense by $1.3 billion to pre-covid levels.

The latest capital raise boosted the diluted share count to at least 1.24 billion shares, up from just 0.7 billion when it entered 2020 before the Covid hit.

Takeaway

The main takeaway for investors is that Carnival has finally lifted most of the remaining Covid restrictions that are holding back bookings. Visitors should now be able to book summer 2023 travel, expecting most, if not all, of the Covid restrictions to be lifted by next year.

The cruise line was a big profit driver in 2019 and the same scenario should be expected in FY23, offset by higher interest expenses. Once Carnival returns to more normal debt levels, the company will return to the cruise line’s full earnings potential. One can buy the $10 stock with a profit potential going back to $3.00, or $1.00 above estimates of $1.50 to $2.00 for the next two years.