One of the hardest hit companies in the market during the COVID-19 crisis was Carnival (NYSE: CCL). Symbolizing the poster child of the pandemic, Carnival and the wider cruise ship industry could do nothing but wait for mobility to normalize. To get to this point faster, the Washington machine implemented a series of fiscal and monetary stimulus programs. Unfortunately, it’s these very efforts that now threaten to sink CCL stock. As a result, I am bearish.

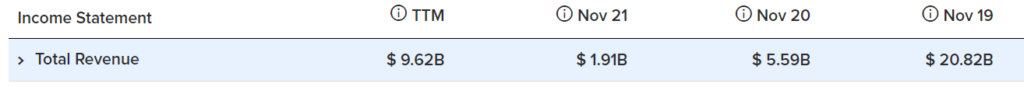

When the SARS-Cov-2 virus ceased to be the exclusive domain of foreigners and exotics and instead spread rapidly across the globe, Carnival couldn’t have asked for a worse stench. In 2019, the company generated revenue of $20.8 billion with net income of $2.99 billion. Fast forward a year later and revenue dropped to an alarming $5.59 billion. Worse still, the cruise ship operator suffered a net loss of over $10 billion.

With people understandably concerned about spending time in close proximity to complete strangers, many consumers chose to shelter in place. Unfortunately, then, CCL stock could only benefit from speculators anticipating a recovery in the cruise line industry. Until the actual recovery took place, Carnival could not begin the slow and painful process of fiscal restoration.

Fortunately, after an uphill battle, local, state and federal government agencies began to ease restrictions related to COVID. In doing so, CCL stock benefited substantially from rebounding travel and pent-up demand for real experiences. However, the story about the carnival was short-lived.

To reach the economic summit, the Federal Reserve had to make a deal with the devil, and the devil wants him to end the bargain now.

Monetary Policy CCL Stock Doomed

As the COVID-19 crisis began to spread, the Fed had no choice but to implement tight monetary policy; that is, it sought to inject liquidity into the system through bond repurchases. By doing so, the money supply grew along with the central bank’s balance sheet. While few were thinking about it at the time, it was at this point that CCL stock slid down the path of inevitability. Going into 2022, consumers began to realize very quickly that inflation had escalated to an alarming level.

With the money supply expanding at an unprecedented rate, the Fed now had to reduce its previous excesses. This meant the shrinking of the balance sheet and thus the reduction of liquidity in the system.

However, the real source of anxiety now is whether the Fed might accidentally push the needle too far. As Reuters reported earlier this month, liquidity in the bond market worsened in part because of the Fed’s tough pivot. Left unchecked, the monetary trajectory can lead to a recession.

Now, the problem for CCL stock is that if the issue is focused on too much liquidity (inflation) or not enough (deflation), consumers will suffer either way. Under the previous framework, people would see the purchasing power of their dollars erode. However, under the latest framework, people could end up losing their jobs due to a broader slowdown in business activity.

For CCL stock, all roads lead to fiscal losses. Indeed, while Carnival is currently on its recovery journey, its trailing 12-month revenue is just $9.6 billion. This is less than half of what the company posted in 2019. Therefore, the cruise ship industry needs a significant boost, which unfortunately does not seem to be on the horizon.

Is Carnival stock a buy to sell or to hold?

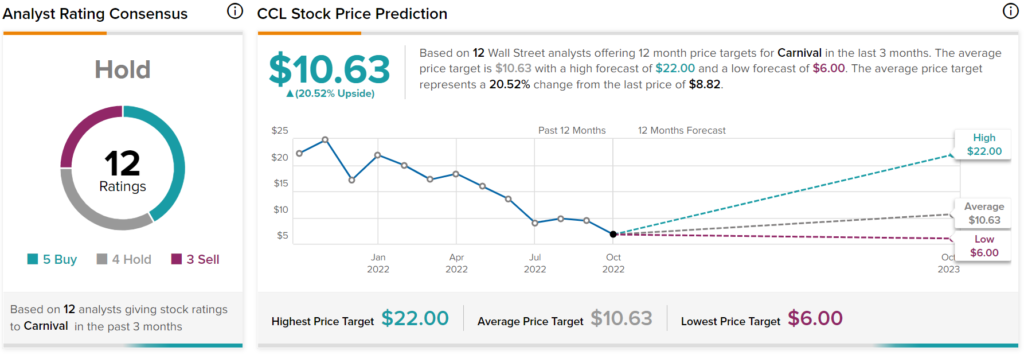

Turning to Wall Street, Carnival shares have a consensus rating of Hold based on five buys, four holds and three definite sells in the past three months. CCL’s average price target is $10.63, implying 20.52% upside potential.

Travel statistics do not bode well for Carnival

Contrarian investors may want to bet on CCL stock. However, data upon data shows that travel sentiment appears to be waning. For example, according to the U.S. Bureau of Labor Statistics, the producer price index for the cruise and tourist reservation industry remains below the first level in March 2020. Of course, this represents a worrying outlook as the March 2020 data are themselves well below levels seen throughout most of 2019.

Further, investors should consider vehicle miles traveled, which have generally been on the decline since February 2022. Although not directly related to the cruise ship statistics, the decrease in people driving on U.S. roads shows a systemic concern. Simply put, people just aren’t interested (or able) to travel.

Finally, market participants should consider revenue passenger miles for US-based air carriers. Since April this year, air travel sentiment appears to have peaked, then declined in June. Again, not directly related to cruise ships. However, across different modes of transport, data sources present a consensus assessment: mobility trends declined.

Thus, investors must recognize the harsh realities. Carnival’s total addressable market is shrinking, which doesn’t bode well for CCL stock.

DISCLOSURE