FedEx on Thursday withdrew its full-year guidance and announced significant cost-cutting measures after what it called softness in global shipment volume.

“Global volumes declined as macroeconomic trends worsened significantly later in the quarter, both internationally and in the US,” CEO Raj Subramaniam said in the release. “While this performance is disappointing, we are aggressively accelerating cost reduction efforts.”

In an interview with CNBC’s Jim Cramer on Mad Money, Subramaniam said he expects the economy to enter a “worldwide recession.”

As part of these cost-cutting initiatives, FedEx will close 90 office locations, close five corporate office facilities, postpone hiring efforts, reduce flights and cancel projects.

FedEx shares fell about 12% in extended trading Thursday.

The updates come alongside fiscal first-quarter earnings that fell well short of Wall Street expectations. The company was scheduled to release the results and hold a conference call with executives next week, but released the report early.

Here’s how FedEx performed in the period ended Aug. 31, based on Refinitiv consensus estimates:

- Earnings per share: $3.44, adjusted vs. $5.14 expected

- Revenue: $23.2 billion vs. $23.59 billion expected

The performance prompted FedEx to withdraw its full-year guidance that had been set in June, citing a volatile environment that ruled out the forecast. The company cut its forecast for capital expenditures for the year by $500 million to $6.3 billion.

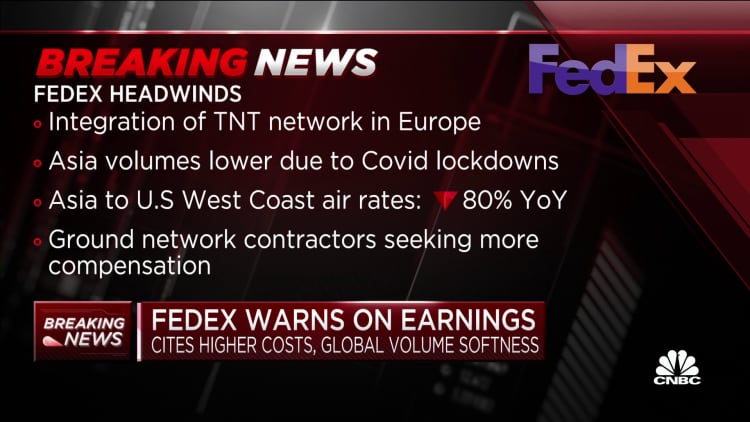

The company cited specific weaknesses in Asia as well as service challenges in Europe for its poor performance in the first quarter. While these factors dampened shipping volume, the company said operating expenses remained high. FedEx reported adjusted operating income of $1.23 billion.

For the fiscal second quarter, the company expects adjusted earnings per share of at least $2.75 on revenue of between $23.5 billion and $24 billion. Wall Street analysts were looking for second-quarter EPS of $5.48 and revenue of $24.86 billion, according to Refinitiv.