Shoe Carnival Inc. reported second-quarter revenue that was below year-ago levels but well ahead of the pre-pandemic quarter of 2019. Sales fell 6 percent year over year. The off-price shoe chain reiterated its EPS guidance for the year.

Highlights of the second quarter compared to 2019

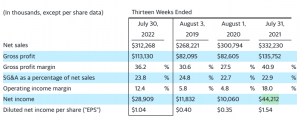

- Net sales increased 16.4 percent with both store banners contributing.

- Based on results during the second quarter, Shoe Station’s banner sales are now expected to exceed previously announced full-year expectations of $100 million by more than 10 percent.

- Gross profit margin increased by 560 basis points.

- Operating income margin increased 660 basis points to 12.4 percent for the sixth consecutive quarter in double digits.

- Q2 EPS of $1.04 (up 160 percent) and year-to-date EPS of $1.99 (up 131 percent) is on track to deliver previously announced full-year guidance in the range from $3.95 to $4.15.

“The Shoe Carnival team delivered outstanding profitability in a challenging economic environment,” said Mark Worden, President and Chief Executive Officer. “The nearly $2.00 of EPS earned during the first half of 2022 is greater than any full-year earnings in our 44 years of operation, excluding last year’s driven results.”

“We are proud to deliver our sixth consecutive quarter of double-digit operating income margin and gross profit margin that expanded nearly 600 basis points versus pre-pandemic levels on both a quarterly and year-over-year basis. The contribution from the Shoe Station banner has exceeded initial expectations and we expect to realize additional synergies and increase the number of stores under both banners. We are optimistic about our long-term growth trajectory and achieving our profitability targets for 2022,” Worden concluded.

Shoe station update

The Shoe Station’s operating results to date have exceeded management’s initial expectations. Previously announced expectations were $100 million in annual net sales and a 10 percent operating income margin. The company now anticipates that the top-line sales target will be exceeded by more than 10 percent and the bottom line contribution will be in line with the company’s expected overall operating income margin of 11.4 percent to 11.6 percent. The company anticipates that further supply chain and omni-channel synergies will be achieved by the end of the fiscal year, with benefits realized in fiscal 2023.

Back to School Update

August merchandise sales through the beginning of the fourth week of August include the highest three-day sales achieved over any three days in the company’s history. Year-to-date August merchandise sales are up in the mid-teens compared to 2019 and down a mid-point compared to 2021. Gross profit margin for August is expected to increase over 650 basis points compared to 2019. The return of The August to -school shopping period drives over half of the company’s third-quarter profitability.

Fiscal 2022 Earnings Outlook

Compared to 2019, EPS growth accelerated during the first half of 2022, rising 107 percent in the first quarter and 160 percent in the second quarter. These results, combined with a solid start to the third quarter, provide the basis for the company’s sales and earnings outlook for fiscal 2022.

- EPS is reaffirmed to be in the range of $3.95 to $4.15, compared to a pre-pandemic annual high of $1.46 in 2019.

- Net sales are expected to be between $1.29 billion and $1.34 billion, up 24 percent to 29 percent over 2019.

- Gross profit margin is expected to be in the range of 36.6 percent to 36.7 percent, compared to 30.1 percent in 2019.

- Operating income margin is expected to be in the range of 11.4 percent to 11.6 percent, compared to 5.2 percent in 2019.

Merchandise inventory

The company ended Q2 2022 with inventory of $385.5 million, an increase of $48.6 million compared to Q2 2019. Approximately 59 percent of the increase is inventory for Shoe Station stores acquired last year or opened this year . The 14.4 percent increase in inventory supports the 20.6 percent increase in net sales year-to-date compared to 2019 and expectations for sales growth for the remainder of the year. The number of weeks of sales in the second quarter ending inventory this year is slightly lower than in 2019.

Operating results compared to 2019

Second quarter 2022 net sales of $312.3 million increased $44.0 million, or 16.4 percent, compared to pre-pandemic second quarter 2019, driven by contribution from Shoe Station stores and new customer acquisition at Shoe stores Carnival with 28 percent. Year-to-date net sales increased $107.8 million, or 20.6 percent, compared to 2019, with both store banners contributing almost equally to year-over-year growth. Sales from the Shoe Station banner stores acquired in December 2021 added net sales of $27.2 million for the quarter and $53.4 million year-to-date.

Manufacturing and supply chain disruptions related to COVID-19 significantly limited the availability of athletic footwear. Based on weekly averages, athletic inventory fell 25.7 percent during the second quarter of 2022 compared to 2019. These lower inventory levels contributed to a 12.9 percent decrease in athletic sales in the quarter. This decline was more than offset by a 30.8 percent increase in non-athletic footwear category sales, increasing overall comparable store sales by 8.0 percent.

Second quarter 2022 gross profit margin was 36.2 percent, an increase of 560 basis points compared to second quarter 2019. Merchandise margin would have increased over 800 basis points, primarily due to increased relationship management capabilities. customers, which have resulted in more targeted promotional prices and higher average selling prices. However, inflationary impacts on transportation and fuel expenses partially offset the increased freight margin and also increased the company’s distribution costs.

Operating income for the second quarter of 2022 was $38.8 million and was 12.4 percent of net sales, an increase of 660 basis points compared to the second quarter of 2019.

Second quarter 2022 net income was $28.9 million, or $1.04 per diluted share, an increase of 160 percent compared to second quarter 2019.

Operating results compared to 2021

Net sales decreased $20.0 million, or 6.0 percent, compared to second quarter 2021 with a comparable store decrease of 13.8 percent partially offset by sales from Shoe Station stores. The comparable store decline was primarily driven by lower athletic sales.

Gross profit margin decreased 470 basis points compared to Q2 2021, primarily due to higher costs, including higher freight and fuel costs, and the deleveraging effect of lower sales on costs of purchase, distribution and occupancy.

In Q2 2021, operating income, net income and EPS were $59.7 million, $44.2 million and $1.54, respectively.

Store updates

The number of stores is on track to reach 400 stores by the end of fiscal year 2022. No store closings are anticipated during fiscal year 2022.

The company is currently modernizing its stores and plans to have over 50 percent of stores modernized by summer 2023 and the full program completed by the end of fiscal 2024.

Share repurchase program

As of July 30, 2022, the company had $29.5 million available for future repurchases under its share repurchase program, and no shares were repurchased during the second quarter.