from Orest Hudziy

IT jobs are in high demand among unemployed workers or graduates, and qualified candidates are in short supply for most positions within the industry. Fintech, however, takes it to another level.

As a booming industry that is constantly changing legacy institutions through disruption and the rapid pace of evolution, financial technologies need people to drive progress. Interest in the industry is at its peak at the moment, and it is no surprise that many people want to have a job offer in this field.

If one is only aiming for monetary benefits (which is fine), wants to join the process of shaping the future of finance or find a place to achieve the maximum result of personal development – fintech is a good place to start looking for a vacant position.

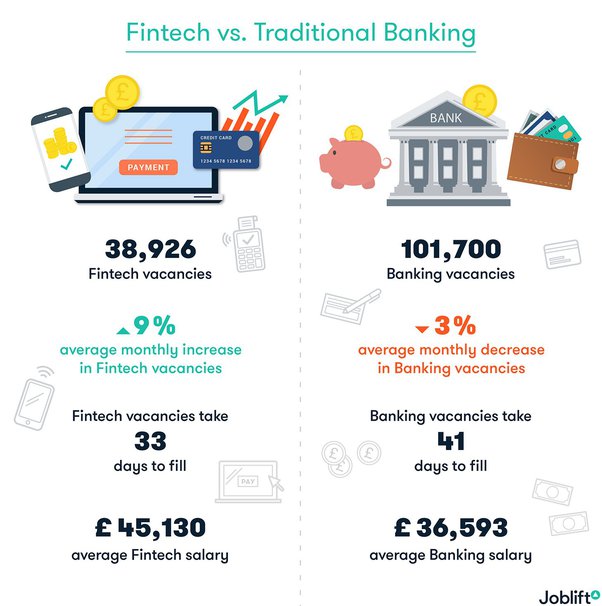

Here’s how Joblift visualizes the positive dynamics of the UK fintech job market (along with some salary numbers) compared to traditional banking positions.

Image source: Fintech and traditional UK banking job markets

The monetary benefits seem obvious. And the thought of changing future technology is also somewhat romantic. It’s time to segment the labor market and explain what exactly the industry needs right now.

Hard skills are at the forefront of FinTech requirements

It will come as no surprise to find that the industry that is driving innovation in the financial segment will require a lot of talent with solid hard skills. Programmers, designers, hardware engineers and more — there’s plenty of room for activity.

Traditional programming leads IT jobs in the fintech segment

Regardless of the field and industry, some good old code writing is required almost everywhere, fintech included. Programmers can find their skill set useful for a variety of projects, from the basic to the more complex. Here is a list of the most common tasks for programmers:

- Website Development (Full Stack)

- Application development

- Application Maintenance

- UI/UX design and implementation

- Product APIs

The list may shrink or grow depending on the region, the company and its field of activity, but you get the general picture. Based on your skills and experience, you can find a job that would guarantee anything from US$80,000 to US$100,000 per year and beyond when you consider the US market.

If you are new to programming and have mastered first-level development, your services will be in demand. If you are skilled enough for more complex issues, fintech is full of platforms to maintain and APIs to create.

AI and Machine Learning jobs become more popular among employers

Fintech has accelerated the means to obtain, analyze and use data from countless sources. Artificial intelligence helps to navigate and find the required information, allowing a more comfortable life for data scientists. However, they need to know how to operate and train AI.

Fintech is poised to pay about 25% more for data science experts than other industries, making it a great choice for those with knowledge about AI and training models. Cost-effectiveness trends require a better conversion of the data received. Petabytes of information must be thoroughly examined to provide a unique user experience for each customer, thereby increasing ROI.

The specialist should be proficient in data science tools and visualization tools, along with query languages and NoSQL databases. Each position will require its own unique set of skills, but the general picture describes exactly these requirements.

Automation is what takes fintech processes to the next level

The original idea of fintech was to deliver better results in less time by reducing costs and providing unique value to the customer. All this had to come from new technology. But while any business model can be improved, so can technology.

Automation engineers will have to address the core of the company and find ways to make it run faster and comply with the original requirements we mentioned in the previous paragraph. Some positions may combine automation with AI, Deep Learning, and Machine Learning, taking it only to the data analysis niche. Regardless, an employee who knows how to make processes more efficient and consume fewer resources would be an invaluable addition to any team.

Cyber security is a must for most fintech companies

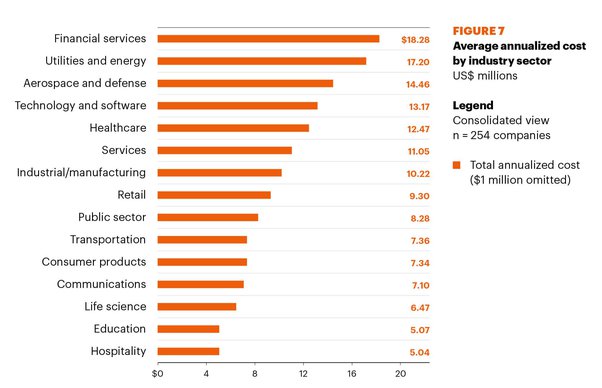

This capability (although it is almost impossible to specify technologies or qualifications that are common or generic) is the door for institutions such as startups and government facilities at the same time. A study by Accenture shows that financial organizations suffer the most from cybercrime, with total costs falling to $18 million for 2017.

Image source: The cost of cybercrime to financial services

The damage caused to other industries by cybercriminals is equally staggering, meaning that a cyber security expert can easily expect to find a job in any of the fields mentioned above.

Blockchain and distributed ledgers as the new trend in financial services

Perhaps the talk of the decade, blockchain is discussed by countless experts, but far fewer can make it work for a given environment.

An expert with blockchain knowledge will be required to build platforms for money transfer (both crypto and fiat), smart contracts, advanced data management, and so on. A skilled blockchain developer can secure a deal that pays anywhere from $100,000 to $250,000 per year, although we were unable to find hard evidence for the latter figure.

Soft skills get more value for most IT jobs

While there is a considerable list of what you can do to succeed in fintech, the nature of the industry requires you to have your soft skills well developed. Fintech originates from the spirit of innovation and agility brought to business by startups, and the soft skills of employees are given great importance on a daily basis. Here are a few you’re likely to come across in most fintech job ads:

- Opening. As a manager, you should be as open as possible with other employees. As a developer or engineer, the same is always preferable. An open person can communicate better, ask for help faster and thus deal with problems much more efficiently than a guy who likes to do everything himself.

- Solving problems. An employee solves a ton of issues on a daily basis, one might say. However, this concept circles the mindset. An employee must be proactive and look for opportunities to improve existing results. Quick thinking is an essential part of problem solving, as it leaves no time for hesitation or panic – only determination and cold analysis of the destination.

- Communication. An opening derivative. It means how well the person integrates with the team both inside and outside the actual work process. Communication allows for more efficient collaboration of departments and teams, thus yielding greater benefits in the end. It is imperative to build strong bonds within the team, so each employee is ready to take on any challenge for themselves and for “that guy next to them”.

- Transparency across the organization. A concept that applies more to managerial staff. The age of startups made traditional management obsolete. No one will judge secrecy, or worse treatment based on position alone. Today’s mentality is about CEOs being equal to junior developers on a human level. When managers are openly discussing random things or project details with everyone else regardless of their position, it creates a bond within the team that is very beneficial to the company.

- Suitability. The atmosphere and workflow of a startup inevitably means issues that anyone will have to deal with regardless of their skill or position. Agility and adaptability are critical for an employee to move up the career ladder within startups or other highly digital environments.

Contributed by Orest Hudziy, Co-Founder of inVerita