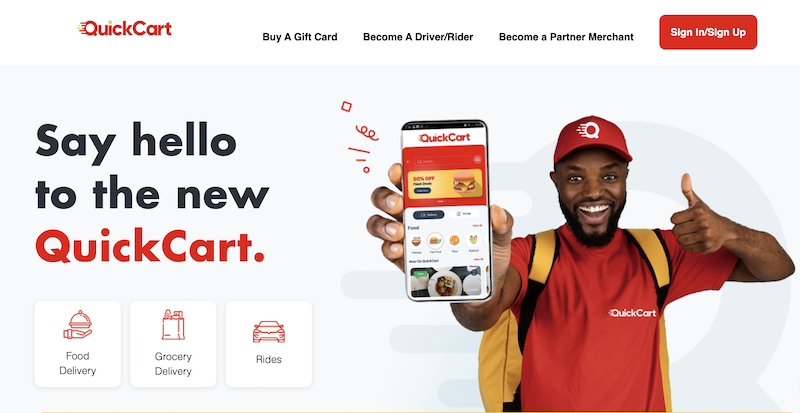

This is a tale of three threads. Each is from the founder of a Jamaican startup/MSME. The first is from Monique Powell, Founder of QuickCartOnline, Jamaica’s leading online food and grocery provider that just expanded to Trinidad. The second is from Rory-Craig Walker, Founder of Jamaica Care Packages, an e-commerce business that provides Jamaican food and snacks to homesick Jamaicans around the world. And the third thread is from Marc Gayle, co-founder of TCPTings, Ata Creative People, an e-commerce first business that makes products reflective of Jamaican culture, including Greeting Cards, “One Bag Ah Tings” Totes and more.

All three entrepreneurs shared stories of doing business with a traditional financial system stuck in their ways it seems, with some entities out of sync with modern entrepreneurs looking for a different way.

That said… read their words taken verbatim from Twitter with their permission.

Topic number 1

Monique Powell, Founder of QuickCartOnline. She shared this thread on Sunday, October 2, 2022

“For online businesses that process all their payments through a local bank, but don’t get love from that bank when it’s time to access credit to level your cash flow, expand, etc., consider incorporating in the US and payment processing through Stripe if your model can support this.

After about 6 months of continuous use of Stripe, you will usually be able to access credit through Stripe Capital within days of applying. They just look at your income, which has a clear picture because after all, they are processing all your payments and. …decide whether to give it to you or not. No bag ah lies long outside. Compare that to a 3 to 4 month process with some local banks.

Here are some companies/services you can use to help you get set up:

– Banded atlas

– First base

Once you’ve set it up, you can also set up a US ‘bank account’ with a service like Mercury without ever having to set foot in the US, which also gives you access to things that should be simple (but locally aren’t ) like setting up expense cards for your team members, etc.

The process is easy, US$400 to US$500 (consider it an investment) and less than 20 minutes to answer a few very simple questions.

You cannot force all our local banks to treat SMEs better, they have their own business considerations and can and should do whatever is right for them. However, you can go where you will be treated better.

Also, if you can make it so that a lot of your company expenses are bills you pay in USD, then you can cover a lot of your expenses directly from that US bank account, reducing the amount you lose in conversion when you repatriate it that must be repatriated.

Easier access to debt also means you’ll have less reason to part ways with equity for smaller amounts you might need just to see you through a cash flow slump or to cover relatively small expenses. You can save capital for larger, more strategic deals versus stop-gap funds.

Topic number 2

Rory-Craig WalkerFounder of JamaicaCare Packages

“Last year @jacarepackages was exploring bank loan options. I went to my current bank and got the same “collateral, collateral etc” story.

I always saw Exim Bank marketing as small business friendly… So I went to EXIM Bank… same story.. collateral this, collateral that. “Do I have any land?”

Then I considered it @DBJamaica for a loan. What I got from them was that it was tied to the same banks that wouldn’t give me a loan in the first place. So I’m hearing and seeing ads about how “Banks are looking for SMEs” because I didn’t like it at all. No luck at all. Then I came across this option from Shopify and was offered a cash advance. Of course, I accepted after the approval. Funds were deposited into my account in 1 business day.

Funds were sent from each JCP sale to settle and everything was paid off. Win-Win!

It needs to be done better for local businesses, not even startups, to have access to funding.

We should not rely on foreign institutions for this.”

October 2020

Topic number 3

Marc – Co-founder of TCPTings

This subtopic is about access to capital in Jamaica for MSMEs and SMEs.

I live in JA and run @TcpThings

We have registered a US entity and use @Shopify

They told me I qualified for their Shopify Capital program, so I applied – Being from (and living in) JA, I wasn’t sure if we would qualify.

Their program is nice because even though it is a little expensive (9% – 17% for the loan amount in USD), you pay it from the sales. Once you have the margin to absorb it, it works fine.

You don’t have to stress about paying off a loan and all that jazz, it just happens automatically.

Anyway, I applied and was notified a few days ago that we got approved.

The application process took about 15 minutes, but several times there were delays based on their requests.

For example, they asked me to send my national ID (I sent my passport), then they asked me to send a picture of me holding my passport up to my face (lol… I know). It’s all uploaded to a secure section of the website.

But just finding the time to do it took me a few days.

Once I did though, it took a few days.

I would say, the whole back and forth process took about 1 – 2 weeks (ignoring my delays).

Once I’m approved, I’m told the amounts I qualify for and I choose which one I want.

I picked it and it was deposited the next day.

Then over the next few days after the sales came in they just discounted it and my balance has gone down.

I was actually shocked that I “did nothing” and already paid off 15% of my balance in less than a week.

It’s a surreal feeling.

So compare all of this to my trying to get a loan from 3 banks in JA and it has been nothing but a pure headache.

I had been trying to do it, off and on, from last October to June/July of this year until finally I just gave up.

Granted, Shopify’s funding is much less than what I was looking for at local institutions, but none of them came back and said, “Instead of taking X, why don’t you start with Y and we can build up to X.”

I wanted to be able to get paid by sales, not by a fixed schedule.

But again, none of the major banks are equipped for this.

I think it is a great indictment of the local financial system. (re: MSME & SME financing), that it is easier for a Jamaican SME to get financing from a non-banking institution in Canada than from any of their local banks.

Nevertheless, we continue.

I am always open to give specific feedback to any financial institution that is interested in taking MSMEs and SMEs seriously.

But you have to do things differently. The world has changed and you have to adapt.”